Business models, consumption and investment behavior as well as the valuation of assets are all influenced by the most important driver of the economy – the price of money, i.e. interest rates. Interestingly, in the so-called free market economy, this is not left to the market, but is controlled by the central banks. This is done in an attempt to stabilize the economic cycle and keep inflation constant. Events in recent weeks have shown that the free-market economy does not fully live up to its definition in other ways either, as once again several banks were rescued with state intervention. Banks are particularly fragile due to their low equity in relation to the overall balance sheet, which is why the first consequences of the sharp rise in interest rates have now become apparent in this sector. If something is fundamentally fragile, it is dependent on external factors such as trust or hope. One of our quality criteria when investing is to ensure that dependencies on individual external factors are as small as possible. Robust earning power over the entire economic cycle in combination with low levels of debt in relation to the stability of earnings is essential. When it comes to our investments, we do not rely on visions, lenders or even the state.

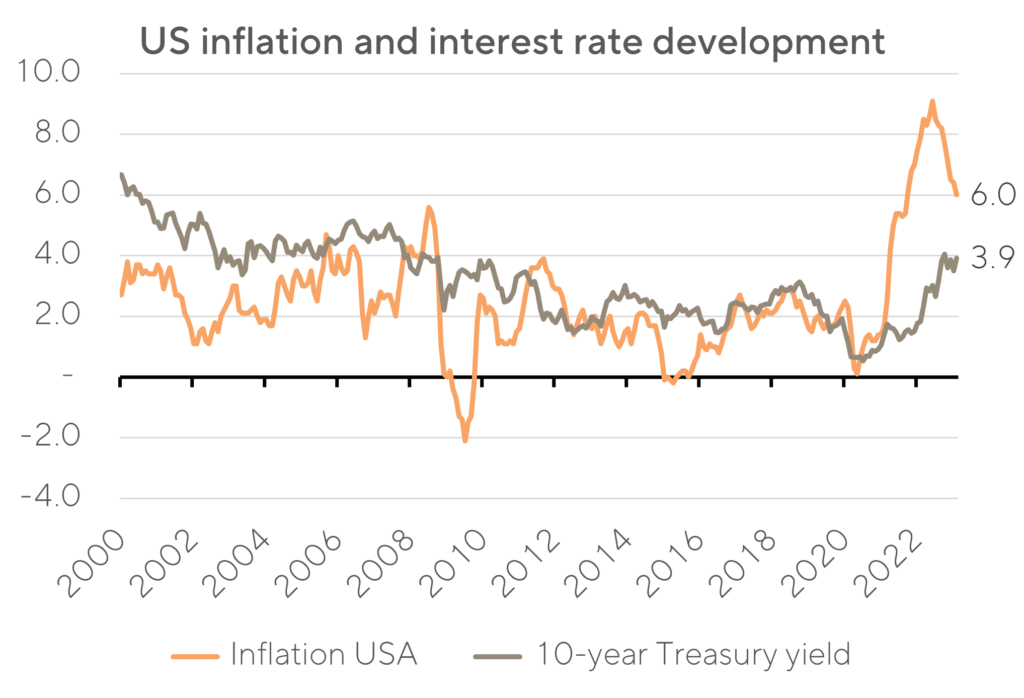

The side effects of low borrowing costs are multifaceted. On the one hand, thanks to low interest rates, borrowers with leasing, mortgages or corporate loans have been able to benefit from negligible borrowing costs, which has strongly stimulated consumption and investments. On the other hand, this has enabled consumption and business models that cannot be sustained at normal interest rates. This leads to a misallocation of resources, particularly with regards to labor, which is detrimental to long-term economic development. Savers, on the other hand, had to invest their money to maintain the prospect of a return. Accordingly, demand for assets was high and, as a result, their valuation increased. With higher interest rates, the initial situation has changed noticeably. Investments in bonds, money market funds and even savings accounts are once again yielding interest. Although these do not compensate for the current high inflation rates, they make a noticeable contribution to reducing the general increase in cost of living. At the same time, borrowers are faced with higher capital costs and the population in general with higher prices due to inflation. All this is a drag on economic development. Nevertheless, the consumer is still in good shape, also thanks to low unemployment, while seemingly still having some catching up to do after the Covid withdrawal.

Central banks across the globe are currently grappling with determining the appropriate magnitude of interest rate increases required to align demand with supply and stabilize prices. The impact of elevated interest rates is not immediate, as the full effects may take time to materialize. While listed asset valuations are known to respond promptly to shifts in interest rates, the efficacy of interest rate increases on borrowers’ interest expenses can take years to fully manifest, contingent on the maturity of the outstanding debt.

In light of the banking sector’s instability, central banks are now confronted with the challenge of effectively balancing the objectives of combatting inflation and stabilizing the financial system. The repercussions of failing to achieve this equilibrium would be significant, encompassing a range of economic and social impacts resulting from both elevated inflation rates and destabilized financial systems.

Given the prolonged period of low interest rates and the rapid pace of the recent rate hikes, it is plausible that additional vulnerabilities may arise over time. The upcoming quarters will provide greater clarity on the extent to which the shift in interest rates will endure over the long term or represent a transitory phenomenon. During times of heightened uncertainty, it is critical to rely on steadfast principles. In our situation, this involves utilizing the superior quality of our investment holdings and the relatively short-term maturities of our bond portfolio to maintain our flexibility.

Zurich, end of March 2023.